The international stock market has grown to become a crucial pillar of the global financial ecosystem, connecting economies, corporations, and investors around the world. With increasing globalization, technology, and access to financial information, individuals and institutions now participate in global equity markets more than ever before. In this article, we’ll explore what the international stock market is, how it works, why it matters, key players, benefits and risks, and tips for global investing.

The international stock market has grown to become a crucial pillar of the global financial ecosystem, connecting economies, corporations, and investors around the world. With increasing globalization, technology, and access to financial information, individuals and institutions now participate in global equity markets more than ever before. In this article, we’ll explore what the international stock market is, how it works, why it matters, key players, benefits and risks, and tips for global investing.

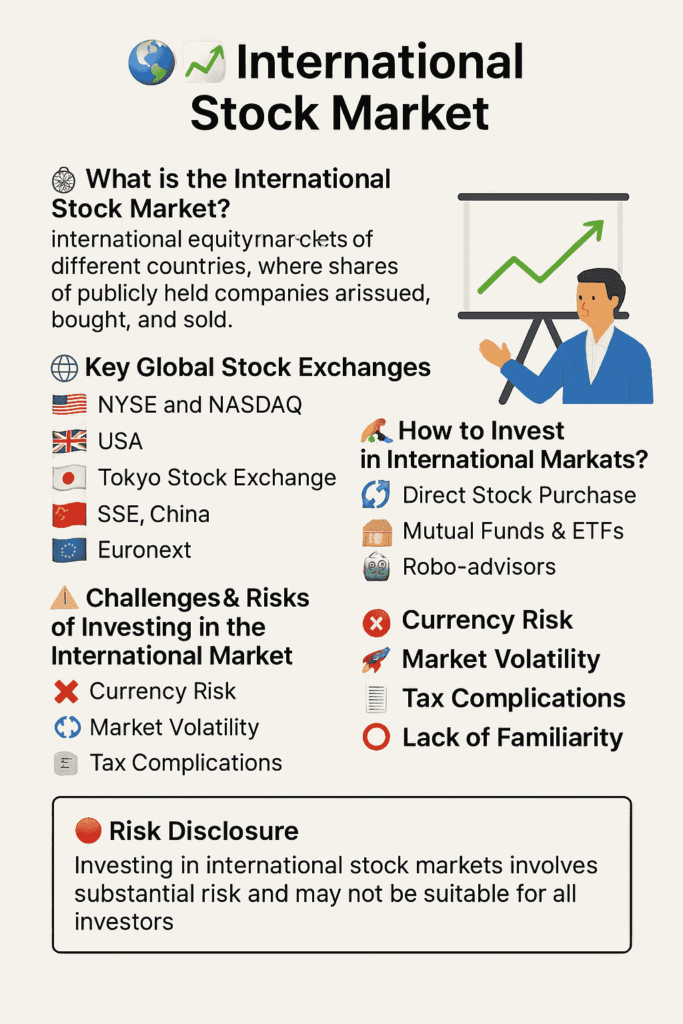

🧭 What is the International Stock Market?

The international stock market refers to the combined equity markets of different countries, where shares of publicly held companies are issued, bought, and sold. While each country has its own stock exchanges, the term “international” implies trading across borders, engaging with foreign exchanges, and holding international equities in one’s investment portfolio.

For example, an investor in India might own shares in Apple (listed on the NASDAQ, USA), Toyota (listed on the Tokyo Stock Exchange), and Nestlé (listed on SIX Swiss Exchange).

🌐 Key Global Stock Exchanges

There are several prominent stock exchanges around the world, each serving as a major hub for trading:

-

NYSE (New York Stock Exchange) – USA 🇺🇸

Largest exchange by market capitalization. Host companies like Coca-Cola and JPMorgan Chase. -

NASDAQ – USA 🇺🇸

Known for tech-heavy listings such as Apple, Microsoft, and Amazon. -

London Stock Exchange (LSE) – UK 🇬🇧

One of the oldest exchanges, with global players like HSBC, BP, and Unilever. -

Tokyo Stock Exchange (TSE) – Japan 🇯🇵

Home to Toyota, Sony, and other Asian giants. -

Shanghai Stock Exchange (SSE) – China 🇨🇳

Features many state-owned enterprises and fast-growing Chinese tech firms. -

Euronext – Europe 🇪🇺

Covers several European countries, including France, the Netherlands, and Belgium. -

Bombay Stock Exchange (BSE) & National Stock Exchange (NSE) – India 🇮🇳

India’s premier exchanges, home to TCS, Reliance Industries, Infosys.

💡 Why Invest Internationally?

Investing in the international stock market provides access to diversified economic opportunities beyond one’s home country. Here are the main advantages:

1. Diversification 🧺

Spreading investments across countries and industries helps reduce risk. For instance, if the Indian economy slows down, investments in the U.S. or European markets might offset the losses.

2. Higher Growth Opportunities 🚀

Some emerging markets may offer faster economic growth compared to developed markets. Investors can tap into these growth stories early.

3. Currency Hedging 💱

International investments expose you to currency fluctuations, which can sometimes work in your favor if the foreign currency strengthens against your home currency.

4. Access to Global Giants 🌐

Want to invest in Google, Amazon, or Tesla? You’ll need to participate in the U.S. markets. Similarly, Alibaba or Samsung are listed outside many investors’ home countries.

🛠️ How to Invest in International Markets?

🔁 1. Direct Stock Purchase

You can buy foreign stocks through global brokerage accounts like:

-

Interactive Brokers

-

Charles Schwab

-

TD Ameritrade

-

Zerodha (India) – through tie-ups for global investing

These platforms allow direct trading in U.S. and sometimes other international stocks.

📦 2. Mutual Funds & ETFs

Many asset management companies offer international mutual funds or Exchange Traded Funds (ETFs). Examples include:

-

Vanguard Total International Stock ETF

-

Motilal Oswal Nasdaq 100 Fund (India)

-

Fidelity International Index Fund

These are ideal for passive investors who want instant diversification.

🤖 3. Robo-Advisors

Platforms like Wealthfront, Betterment, and INDmoney use algorithms to manage globally diversified portfolios.

You can also read: Investing in Gold vs Cryptocurrency: Where Should You Put Your Money?

🔍 Key Factors to Consider When Investing Internationally

🌎 1. Economic Conditions

The strength and growth prospects of a country’s economy influence the stock performance. For example, China’s GDP growth impacts Chinese tech stocks.

🏛️ 2. Political Stability

Political upheavals or trade policies can significantly affect international investments. A change in government in Brazil or new sanctions on Russia can impact investor sentiment.

💰 3. Currency Risks

Exchange rate fluctuations can either boost or reduce returns. If the foreign currency weakens, your investment value in local currency terms can decline.

📜 4. Regulatory Environment

Understand the rules, taxes, and financial regulations of the country in which you’re investing.

🕒 5. Time Zones and Market Hours

Markets operate in different time zones. Be mindful of trading hours, especially for active traders.

🌍 Popular International Stocks & Companies

Here’s a look at some popular non-domestic companies that attract global investors:

| Company | Country | Sector |

|---|---|---|

| Alibaba | China 🇨🇳 | E-commerce |

| Nestlé | Switzerland 🇨🇭 | FMCG |

| Samsung | South Korea 🇰🇷 | Electronics |

| Toyota | Japan 🇯🇵 | Automotive |

| Novartis | Switzerland 🇨🇭 | Pharma |

| Royal Dutch Shell | UK-Netherlands 🇬🇧🇳🇱 | Energy |

🏆 Benefits of International Stock Market Participation

🔄 1. Improved Portfolio Performance

Foreign markets may outperform local markets in certain periods, helping improve overall portfolio returns.

🌐 2. Exposure to Innovation

Many tech and biotech innovations originate from the U.S., South Korea, Israel, and Europe. International investing helps tap into these.

🧱 3. Access to Different Economic Cycles

While one economy might be in recession, another could be booming. International exposure allows participation in various economic cycles.

⚠️ Challenges & Risks of Investing in the International Market

While the benefits are compelling, it’s important to understand the potential downsides.

❌ 1. Currency Risk

Exchange rate movements may erode your returns, even if the stock performs well in its local market.

📉 2. Market Volatility

Emerging markets tend to be more volatile due to political risk, inflation, and policy shifts.

🧾 3. Tax Complications

You may be subject to withholding tax, capital gains tax, and other levies depending on your country and the country you’re investing in.

⛔ 4. Lack of Familiarity

It’s harder to understand foreign markets’ cultural and business nuances compared to your home country.

💼 5. Higher Fees

Brokerage charges and conversion fees can be higher for international transactions.

📊 Case Study: U.S. vs. Emerging Markets

Let’s compare investing in S&P 500 (U.S.) vs. MSCI Emerging Markets Index over the last decade:

-

S&P 500 (2013-2023): Approx. 12% CAGR

-

MSCI EM Index (2013-2023): Approx. 3-5% CAGR

Although the U.S. market outperformed, emerging markets could bounce back during global recovery periods or commodity booms.

🛡️ Risk Management Strategies

✅ 1. Diversify Across Regions

Don’t just pick one or two international stocks. Invest in funds or ETFs that cover multiple regions.

✅ 2. Use Hedged Funds

Some funds offer currency-hedged versions, reducing the impact of currency fluctuations.

✅ 3. Invest Through SIPs

Systematic Investment Plans (SIPs) in international funds help average out the risk over time.

✅ 4. Stay Informed

Follow global economic news, central bank policies, and geopolitical events.

💼 Institutional Role in International Investing

Large institutions such as sovereign wealth funds, pension funds, and hedge funds play a key role in the global market by deploying billions of dollars across continents. Their strategies often influence international market flows.

For example:

-

Norway’s Sovereign Wealth Fund invests in over 70 countries

-

BlackRock manages global ETFs and funds across various regions

🚀 The Future of International Investing

With the rise of decentralized finance (DeFi), digital currencies, and AI-based investment tools, cross-border investing is becoming simpler and more accessible.

-

Tokenized stocks may enable real-time global trading

-

AI tools can screen global stocks using language models

-

Blockchain ensures better transparency across markets

Moreover, developing nations like Vietnam, Nigeria, and Mexico are emerging as new investment frontiers.

📢 Risk Disclosure 🛑

Investing in international stock markets involves substantial risk.

Foreign securities are subject to currency risk, political and economic instability, different regulatory environments, and potential liquidity issues. Historical performance does not guarantee future results.

Always conduct thorough research or consult with a certified financial advisor before making international investment decisions.

Your capital is at risk, and you may not recover the amount initially invested.

📝 Conclusion: Think Global, Act Wisely

In a world where economies are interconnected and digital access is widespread, the international stock market offers exciting opportunities for growth, diversification, and long-term wealth creation. However, these come with their own set of risks and complexities. Whether you’re a beginner or a seasoned investor, taking a disciplined, informed, and diversified approach will help you make the most of the global financial markets.

Hello guys! My name is David Wilson, and I'm a passionate stock market enthusiast and the founder of 9to5Stock. With a deep understanding of market dynamics and a commitment to empowering others, I share valuable insights, strategies, and updates to help investors like you make informed decisions and achieve financial success. Welcome to our community, and let's thrive together in the world of investing!